A Data-Driven Guide to Zombie PE Funds

A few of my PE friends are recently out of jobs because they joined the wrong kind of funds, zombie funds.

What is a Zombie Fund?

A zombie fund is a private equity vehicle that has outlived its intended lifespan but still holds unsold assets, often with little prospect of generating strong returns or raising a successor fund. Instead of distributing cash back to investors, these funds linger with illiquid portfolios, low distributions, and repeated extensions. While not always malicious, they tie up capital, create conflicts of interest (especially with continuation funds), and signal that the GP’s strategy or execution is struggling.

Why Funds Become Zombie Funds

- Weak exit markets (IPOs, M&A, strategic buyers dried up).

- Valuation mismatches — unwillingness to sell below paper Net Asset Value (NAV).

- Failure to raise a successor fund.

- GP incentives to keep management fees flowing.

- Complex or illiquid portfolio companies needing more time.

Why This Matters To You

- Job seekers: A zombie firm often means weak carry, shrinking management fees, and huge career risk.

- Vendors (data providers, bankers, consultants): Selling into a firm with no fresh fund or distribution prospects is low-ROI.

- Sell-side advisors: Including zombies in process lists may waste time; they don’t have fresh capital to transact on platform deals.

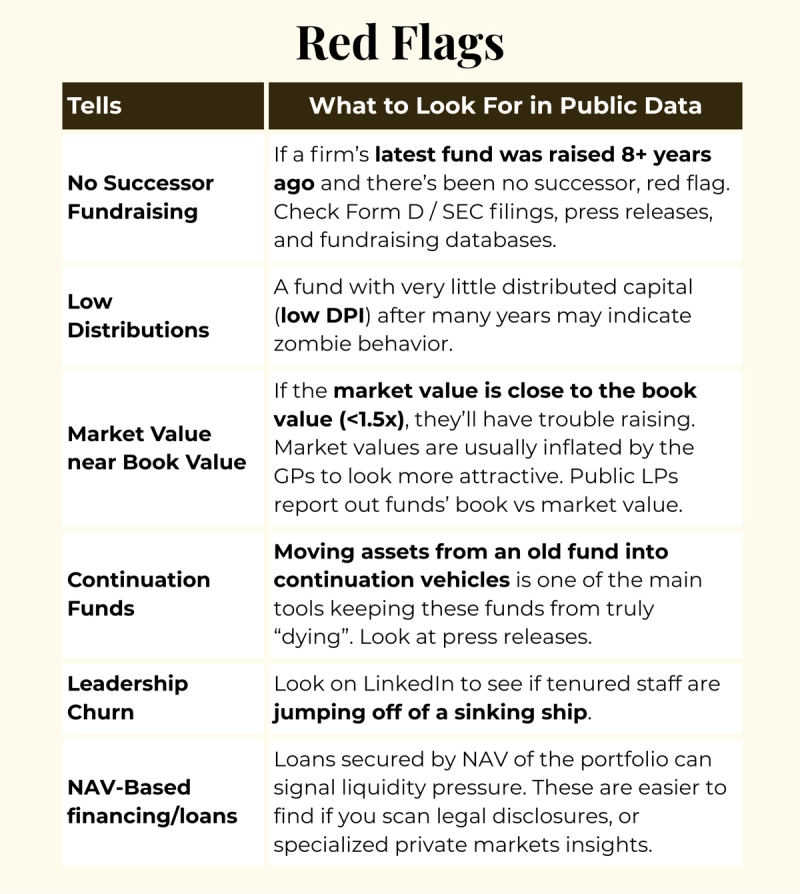

Top Public Data "Red Flags"

Public Data Examples

- LP Report with Book and Market Value: https://www.calpers.ca.gov/documents/annual-investment-report-fy-2024/download?inline

- Continuation Fund Press Release: https://www.prnewswire.com/news-releases/avista-healthcare-partners-closes-continuation-fund-for-gcm-302490198.html

- Leadership Switching Funds: https://www.atlpartners.com/news/atl-partners-hires-seasoned-investor-caleb-clark-as-senior-partner/

- NAV-Loan Press Release: https://www.crestlineinvestors.com/news-insights/crestline-completes-50-million-nav-loan-upsize-to-an-existing-borrower-to-support-growth-and-liquidity-needs/

These examples are not meant to say the firms mentioned are "Zombie Funds". Do your own homework! These links merely show that there is a lot more publicly available data to review than one may think. We don't want to be dealing with defamation claims.

Conclusion

Zombie firms aren’t overtly evil or fraudulent; often they’re just caught in bad timing: high rates, weak public exit markets, overhang of valuations, etc. Sometimes they're just average fund returners and the bar for new funds just keeps raising. But for people working in or with PE firms (employees, vendors, analysts), you can avoid bad deals or careers by knowing what public data to check. By paying attention to vintage dates, NAV vs distributions, exit activity, and continuation/secondary volumes, you can spot walking-dead firms before you sign on.

If you're at a PE firm and want to avoid a sad fate, talk to Scend to improve your returns and keep the good times going!

Anirudh Sathya

September 25, 2025