Blog

Private Equity

9 Predictions for PE in 2026, Starting with AI Rollups First

AI rollups are coming for PE, and they’ll force a shift from spreadsheet work to operating systems, trust, and execution. Nine sharp trends that will shape how deals get sourced, diligenced, and won in 2026.

Anirudh SathyaJanuary 6, 2026

Middle MarketGrowthEnterprise

Private Equity

A Data-Driven Guide to Zombie PE Funds

Spotting zombie PE funds: why they linger, the red flags, and how public data helps you avoid career and deal flow dead ends.

Anirudh SathyaSeptember 25, 2025

GrowthEnterpriseMiddle Market

Private Equity

There's No Thought Leadership in PE, Yet

PE firms are missing their Sequoia & a16z moment. VC firms mastered podcasts, blogs, and media. PE hasn’t. Here’s how AI-forward PE firms can turn IC memos into blogs, newsletters, and podcasts to win LP trust and deal flow visibility.

Anirudh SathyaSeptember 4, 2025

Middle MarketEnterpriseGrowth

Sourcing

How Complete is Your Deal Sourcing "Waterfall"?

Don't settle for partial data. Learn how to build a complete deal sourcing waterfall to ensure your pipeline captures every key opportunity.

Anirudh SathyaJune 20, 2025

EarlyGrowthEnterpriseMiddle MarketSMB

Value Creation

PE Firms Using GenAI Early Are Seeing Higher Exit Multiples

Discover how private equity firms are using GenAI to unlock revenue growth, cut costs, and boost exit multiples—plus why partnering with builders like Fractional AI could be smarter than hiring a AI-focused CTO.

Anirudh SathyaJune 11, 2025

GrowthMiddle MarketEnterprise

Sell-side M&A

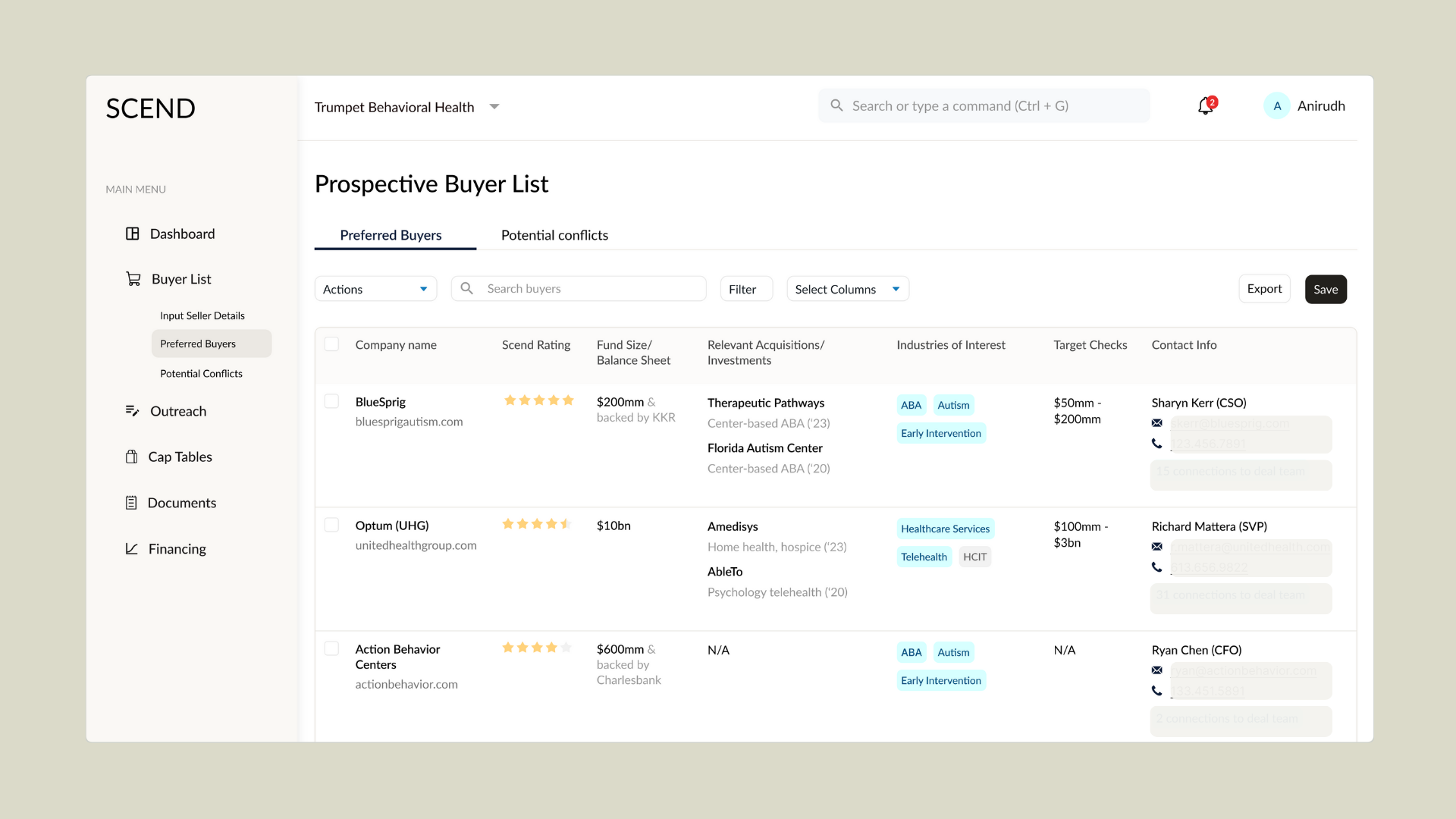

How Do You Make A Great Buyer List?

Learn how to build a buyer list when selling your business and how bankers probably can do a better job than you, if you don't have the expertise.

Anirudh SathyaFebruary 23, 2025

EnterpriseMiddle MarketSMB

Sell-side M&A

Broad Auction M&A Processes Should Be More Common

Broad auctions in M&A maximize competition, drive higher valuations, and reduce risk—except in rare cases.

Anirudh SathyaFebruary 13, 2025

EnterpriseMiddle Market